Inflation dropped slightly, to 7.1%, according to the Fed's calculations.

Gasoline prices are down. Home prices are down.

I notice gasoline prices. It had been $5-something in Oregon. Now it is under $4. The WTI (West Texas Intermediate) price is now $75/barrel, a price at which it is still profitable for oil companies to drill and frack, but no longer a spectacular windfall. U.S. oil companies did not over-react to the brief period of oil at $120. The "capital discipline" they exercised a year ago--to the condemnation of people who urged they ramp up production in the face of Russia's invasion of Ukraine--turned out to have been prudent.

If oil prices settled at the $70s range, U.S. oil companies could profitably meet U.S. demand. Energy prices would have a modest effect on inflation, neither inflationary nor deflationary. It is not the nature of oil prices to settle at an equilibrium. That is why energy prices are excluded from inflation calculations.

In COVID's early months, U.S. shutdowns caused American to buy more physical stuff from China. Our ports clogged up. Now China's severe COVID lockdown policy is slowing Chinese manufacturing. That is hurting U.S. supply chains, which is inflationary. Exports from China fell 8.7% from last year. Imports into China fell 10.3%. The slowdown shows up in the dramatic drop in trans-Pacific shipping costs. Ships were stuck at sea waiting to get dock space. We are back to normal, which is deflationary.

Home prices are dropping. The Fed calculates rent into inflation by imputing a rent that a homeowner would pay if they were renting that home. In fact, once a person buys a home, that price is locked in. Calculations don't match lived experience. Housing rents, too, tend to be "sticky" with rents locked in from year to year. Still, housing is such a large part of a family budget, it needs to be figured in somehow. At any one time, some people are buying or selling homes and some people are looking for a place to rent. Those people set the market price for everyone else in inflation calculations.

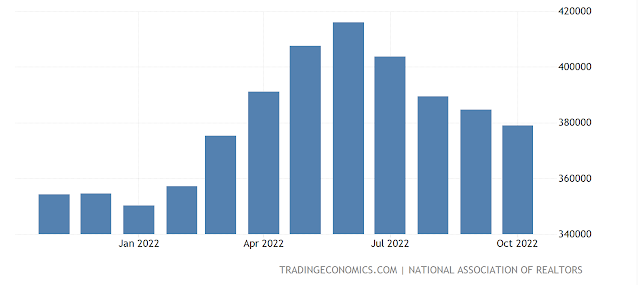

For the purposes of Fed calculations of inflation, the housing component is dropping, as the chart shows. Notice that the right axis is not zero, so the apparent drop is exaggerated in the chart, but home prices are down about 9% nationwide and far more than that in some markets.

I rent out an updated farm house built by my grandparents 99 years ago. It is a two bedroom, one bathroom place with about 1,100 square feet. I was inundated with rental applicants at $1,400 a month. The rental market in Medford is skewed by the fire two years ago that destroyed over 2,000 homes.

Some places in America have rents that seem impossibly high to me. They are bright blue cities where jobs are being created. Fox News and Republican officeholders describe these as hell-holes of violence, crime, and misery run by Democrats, yet apparently people want to live there. These are the most productive places in America, creating wealth and taxes that support the nation.

I lived in Boston almost 50 years ago 1973-1975. My apartment was a 12-minute walk from a subway station where I took the train to downtown. It was in a working class neighborhood, called lower Dorchester. The place today is still there and apartments like mine rent for $2,150/month.

When I lived there the floors had gold carpets. The countertops were formica. There was a "great room" with kitchen appliances along one wall. There was one small bedroom and a bathroom. I would estimate 600 square feet total for the place. There were coin operated washing machines and driers in the basement.

Inflation is getting better, but on the margin for young adults the overall affordability of life is harder than it was for me. This has been an era when Fed policy inflated assets. The great stock market of the past 40 years is irrelevant to young people. They weren't alive for it. The rise in housing prices didn't make them wealthy. It made houses unaffordable.

Boomers like me might be surprised at the prices charged by tradespeople or others doing personal services for us. It seems so high. But people who have owned a home for decades have lost touch with inflation. People in their 20s entering the workforce are experiencing the other side of the tremendous increase in housing prices.

[Note: To get daily home delivery of this blog go to https://petersage.substack.com Subscribe. The blog is free and always will be.]

4 comments:

There are lots of articles of young adults now living with their parents due to high rent costs. Doesn’t seem possible to have a minimum paying job and have any kind of life. A friend tells me in whitefish Montana a Burger King sign lists jobs available for $23 an hour, but remains unfilled. The trouble is that Realestate is so expensive there workers can’t afford to live there.

Appreciate your post today. 20 year olds in small towns like Klamath Falls or Yreka find themselves trapped between staying in affordable towns with no jobs or moving to bigger markets with jobs that are unaffordable. No wonder the addiction rates in such places are so high. Hope is gone.

This kind of high rent also impacts seniors on a limited income. I have very low rent in an apartment in Ashland, as I have been here for going on 30 years, so they leave me alone. But it is still a bit more than half of my income per month this year. If something happens to my place or if I had to move out, I am screwed.

There would be a long line for low income assisted housing. Especially as those affected by the 2020 fire are possibly still looking for housing.

This is one of the reasons we have so many homeless. Those Baby Boomers can be very judgmental about them, but our generation created the situation over many years. I paid my college tuition with summer jobs and work/study programs, but now students graduate tens of thousands of dollars in debt.

Our national debt already exceeds our GDP and it's likely to get worse before it gets better. Not good.

Post a Comment