Good news is bad news.

A strong economy means the Federal Reserve needs to create some pain.

The Federal Reserve is trying to stop inflation using the tools it has. By raising interest rates and reducing the money supply they will slow the economy. Ideally they will create a soft landing. That means they will raise unemployment a little, but not too much. That means the economy will slow, but not go into a full-fledged recession. It rarely works out that way.

It is 5:29 a.m. on the West Coast as I type this. In one minute the monthly jobs report will be announced. Last month--July--the economy grew 528,000 new jobs. It was only expected to grow by 318,000. Good news for job seekers was bad news for the Fed. It meant the economy is still humming along too fast to slow inflation. Inflation is not cured by putting young, marginal employees out of work. Poor people are not the drivers of a consumer economy because they don't have much money to spend. Unemployed workers are a signal that businesses up and down the economy have fewer customers and less business to do, and therefore the economy is slowing.

It is time. Let's check on the number:

Payrolls rose 315,000 in August. Unemployment rose, from 3.5% to 3.7%, reversing a trend of ever-lower unemployment that had been in place since the COVID shutdown of spring, 2000. Workers who hoped for a tight labor market will be disappointed. The Fed will be happy. Something is slowing the economy.

This week Fed Chairman Jerome Powell spoke at an annual conference at Jackson Hole, Wyoming. He said the Fed would do whatever was necessary to stop inflation. The job number just announced won't stop the Fed from continuing to raise interest rates. It is the tool the Fed has. Senator Elizabeth Warren commented that we

still have supply chain kinks, that we still have a war going on in Ukraine that drives up the cost of energy, and that we still have these giant corporations that are engaging in price gouging. There is nothing in raising the interest rates, nothing in Jerome Powell's tool bag, that deals directly with those. . . .

Do you know what's worse than high prices and a strong economy? It's high prices and millions of people out of work.

|

| https://www.youtube.com/watch?v=FcXODiINQoE |

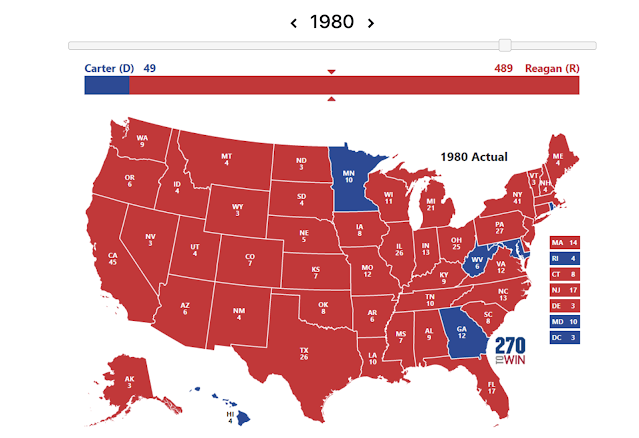

We have had high prices and people out of work before. I lived it. It was a miserable period for incumbents. In 1980 Jimmy Carter was president and the then-Fed chair was squeezing out inflation by raising interest rates. Ronald Reagan called the sum of the inflation rate and unemployment rate the "misery index." People blamed Carter and they wanted change. It's the economy, stupid.

High inflation and high unemployment are a disaster for the party in the White House. Currently the leaders of one of the two parties are following Trump and their primary election voters into declaring the 2020 election stolen. This week Trump said he wanted the election reversed, or failing that, done over. It is preposterous and unconstitutional. Trump said if elected he would pardon people arrested for participating in the Capitol riot. Did the GOP rise up in open rebellion to this kind of talk? No. Officeholders and candidates defend him. It is a new GOP. They may win election. It is a new electorate.

The 2024 election will almost certainly be protested if a Democrat wins, but protesting it might not be necessary. In an environment of high inflation and unemployment the public wants change. Trump would be the change.

[Note: To get this blog daily by email go to https://petersage.substack.com Subscribe. The blog is free and always will be.]

4 comments:

“People blamed Carter and they wanted change.”

So, they elected Reagan, who promoted "supply-side" (a.k.a. voodoo) economics. The notion was that deregulation and cutting taxes, especially for the rich, would produce benefits that “trickle-down” on the rest of us (that’s why we’re called pee-ons). They figured that less money collected in taxes would magically produce more. It’s worked so well that we’re now over $30 trillion in debt.

Ever since that time, the conventional wisdom has been, “It’s the economy, stupid,” but that may be changing. A recent NBC poll showed that threats to democracy overtook the cost of living as the top issue facing the country for voters (https://thehill.com/homenews/campaign/3610753-threats-to-democracy-top-list-of-issues-facing-us-poll/).

Is it possible the country might be coming out of its stupor?

Probably the biggest mistake people make in this regard is giving the government more blame, and credit, for the economy than it deserves. They conflate their own prospects with the larger economic conditions to the extent they are paying attention. The numbers and statistics reflect the actions of millions of individuals and organizations, all toiling away for their own benefit, and not just in this country but now worldwide, something that is the literal definition of chaos.

It's unfortunate, but politicians...not something they are going to admit, right?

Our best shot is a free society where everyone will be fairly rewarded for their efforts, with a government that will make every effort to assist them. This is what is at risk now that Republicans, since St. Ronald, have chosen the opposite.

While the Fed has the two tools you mentioned--setting the prime interest rate and controlling the money supply--to stimulate or damp down the economy, Congress has a powerful tool as well, taxing and spending. If I understand what Warren was saying from the short excerpt of her remarks that you included in this post, taxing corporate profits is a fine tool. I'm not sure what effect the required corporate minimum tax of 15% will have on reducing inflation--my knowledge of economics is rudimentary. But it should have some.

If the economy goes down the drain, a Republican is likely to win in 2024. Here’s hoping that Merrick Garland (or one of the other prosecutors) has something strong enough to take Trump out of the picture by then, so that we end up with someone competent running the country.

Post a Comment