The Social Security Trust Fund is depleting.

At first thought, COVID might appear to fix that problem. After all, seniors are dying off faster than expected.

Think again. COVID made things worse.

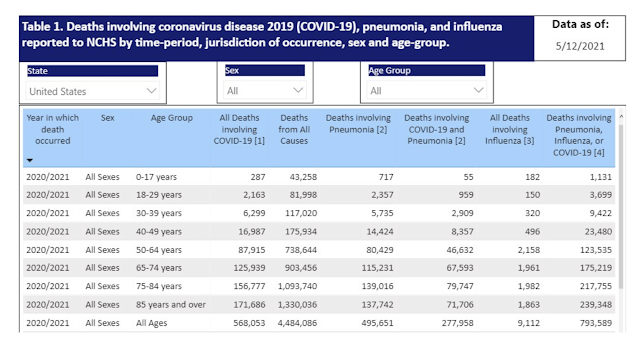

It is undeniable that COVID hospitalizations and mortality target the elderly. This chart, from the CDC this week, is not surprising to people who follow the general news. Nearly 600,000 people have died from COVID. Deaths are concentrated among the oldest Americans.

Those excess deaths caused a drop of a full year in life expectancy. Life expectancy for Americans had been flat and slightly down in the pre-COVID years, due to excess opioid deaths plus earlier deaths due to obesity and diabetes, but only marginally. COVID caused a sharp drop.

The chart is from PBS.

Put those together and it would seem logical that--macabre as it is to notice and write it--possibly COVID has a net effect of nudging the Social Security Trust Fund away from depletion--a silver lining in a very bad cloud.

In fact, COVID has accelerated the depletion rate, because Social Security is a mix of both income-in and payments-out.

COVID was not just a disease that targeted seniors. It is also a pandemic that changed the American economy. By policy we shut down much of the economy and put people out of work. Social Security taxes earned income via a payroll tax. Earned incomes are down, meaning less money in. Government programs provided some income support, but the cash payments and extra unemployment insurance payments aren't subject to payroll taxes.

There was also an exit from the labor force. People stayed home to deal with children not in school. People dropped out of the labor force because they considered themselves at risk of getting sick. Plus disability claims go up at times of layoffs. Marginally-healthy employees transition from working-while-hurt into "disabled" because the overall effect on the economy tipped them over the edge.

Death is a personal and family tragedy. Yet everyone dies. The extra mortality from COVID did not change significantly the years-of-life-lost number. Seniors dying from COVID--about 500,000 so far--are one percent of the 50 million Americans age 65 and older. The people hospitalized and dying are primarily--not all, but primarily--people who were already sick with something, and possibly just "old age." They had a co-morbidity. COVID shortened their lives, but not by many years.

COVID deaths have been concentrated among people at the lower end of the economic scale, whose Social Security payments were based on lower lifetime earnings. Since their earnings were smaller, therefore Social Security benefits that did not get paid them due to their shortened lives were also smaller.

Interest rates are very low. The Social Security Trust Fund gets income from payroll taxes, but it also is an investment pool credited with earnings at the rate of US Treasuries. The unusually low interest rate is a policy effort to deal with the COVID recession. Low interest credits reduce the growth of the Trust Fund.

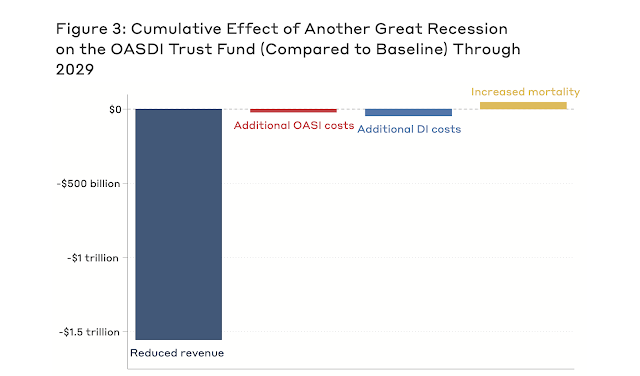

SCALE. The scale of reduced income to the Trust Fund due to a COVID recession, balanced by reduced costs due to increased mortality, is dramatic and unintuitive. Here is the Congressional Budget Offices's graphic depiction. The reduced revenue is the far, far greater influence.

Summary: COVID did not "solve" a Social Security solvency problem.

A very different approach, one of letting COVID run its course, treating it as just a normal case of the flu, was on the policy table and was an early effort by Trump in the first months of 2020. It would have taken the course of not shutting down the economy and not letting "the cure be worse than the disease." That would likely have had a different outcome. The young and healthy would have continued working, restaurants and bars and offices and transit systems would have continued operate. People would get sick and most would recover. However, vastly more seniors would have gotten sick and died earlier than expected. America flirted with that strategy and some favor it still, but we did not do it. Too many hospitals and morgues were filling up too fast. At the critical time at the beginning of the pandemic Americans decided we needed try to stop the disease, not live with it and take our chances.

We chose to save lives.

4 comments:

Interesting, but probably a little more complicated than we think.

I generally think in terms of "economic activity" because most people spend all their income and I don't separate SS income from employment. Looking at it that way, the total activity was down across the board, causing a recession initially but now fueling inflation because of lower productivity and the resultant scarcity.

How does this get fixed? One way will be to increase interest rates, and I expect to see that, though it won't be popular. On the other hand the jobs bill will goose the economy, and give some workers a chance to catch up.

Social Security and Medicare are a necessary and prudent way to manage the economy. Otherwise the cost of aging citizens is a bigger burden on society; one reason being it chokes off opportunities for younger workers if seniors are forced to keep working.

Republicans can stay in office by characterizing these common sense programs as "handouts" and "socialism". Their wealthy donors are trying to avoid paying the taxes necessary to fund them, and the bigoted and ignorant enjoy the pandering.

The subtext of this is that some see citizens having little value once past their productive years and as such expendable. Again, "soft genocide".

Focusing on the balance in the SSI Trust Fund has been a red herring ever since Republicans raided it under Reagan 40 yrs ago

https://www.fedsmith.com/2013/10/11/ronald-reagan-and-the-great-social-security-heist/#:~:text=The%20mechanism%2C%20which%20allowed%20the%20government%20to%20transfer,to%20support%20a%20hike%20in%20the%20payroll%20tax.

https://dissidentvoice.org/2013/09/ronald-reagan-and-the-great-social-security-heist/

If someone has a marginal SS disability claim, i.e., the person actually stopped working for non-medical reasons, their claim will be denied. SS does not hesitate to deny claims. Most claims are denied. The appeal process can take several Years (not months) and most will still be denied. Because of COVID, the process has been even slower than usual. Any disability lawyer will tell you this, or do some research on the internet.

Additionally, the difficulty obtaining SS disability benefits is one of the reasons we have a significant homeless problem in our country. If someone cannot work OR get disability benefits, there is a good chance they will become homeless.

If approved, the benefits are minimal. This and the lack of affordable housing also contribute to homelessness. The Baby Boom has been another major factor.

Post a Comment