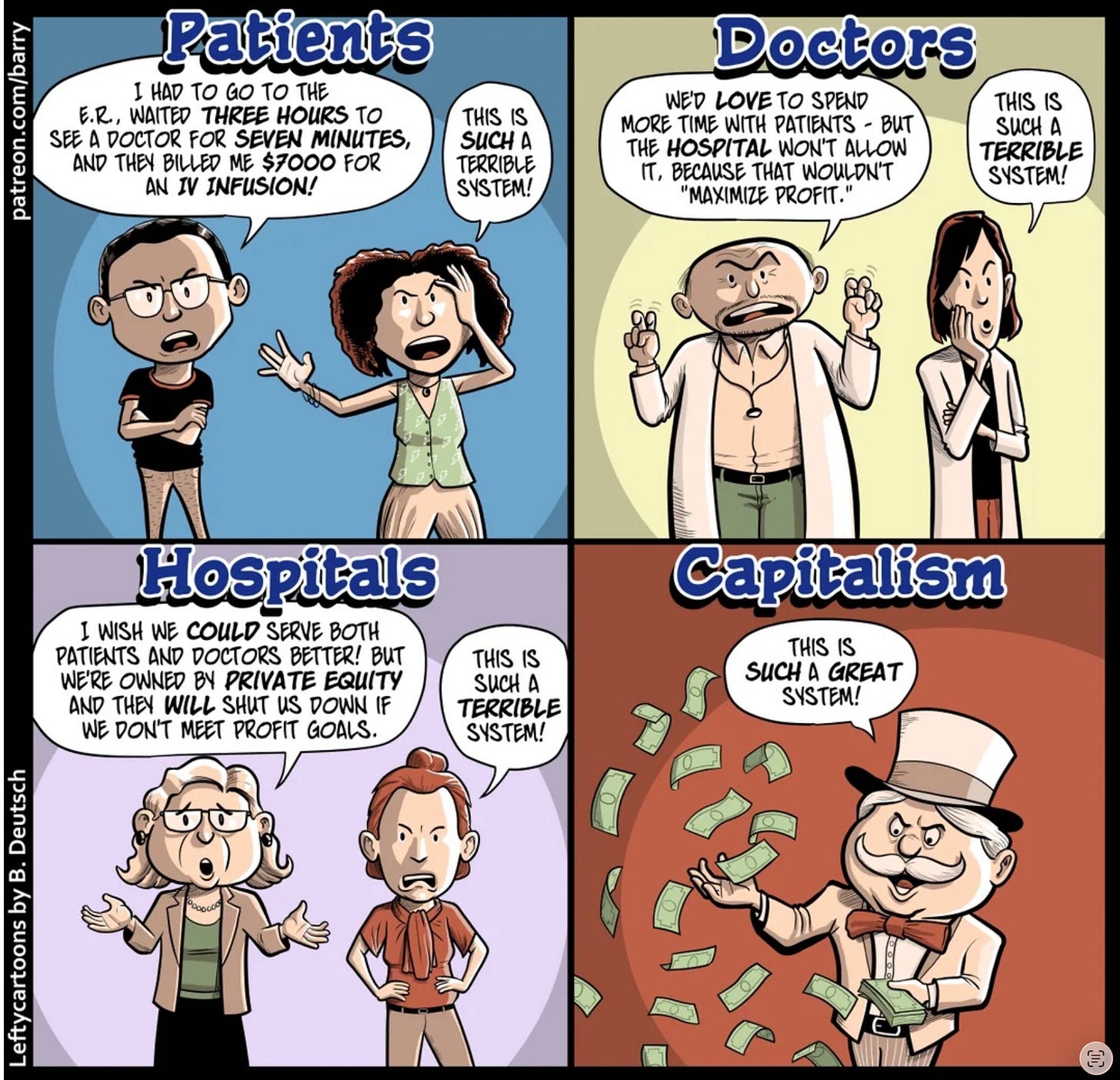

The U.S. healthcare system costs more than the systems in peer countries.

Our health outcomes are no better.

U.S. Senators Elizabeth Warren (D - MA) and Josh Hawley (R- MO) have introduced a bill to change that.

Bruce Van Zee is a retired nephrologist. He lives in Medford, Oregon and calls himself a "Never Trumper." He began sharing his thoughts during this second Trump term in his new blog on Substack. He allowed me to republish his post from yesterday, a welcome bit of good news amidst news of the Iran war, "unconditional surrender," inflation, job losses, and the drip from the Epstein coverup. He would welcome new subscribers: https://bvzcvz.substack.com

|

| Van Zee |

Break up Big Medicine Act

Some Hopeful News about For-Profit Medicine

Imagine being in the market for a home. You contact a realtor who agrees to show you some homes for sale. You find a home you like and submit an offer. The offer is accepted and your realtor then refers you to a mortgage bank, home inspector, and a title company. You are a bit surprised by the steep fees of the companies, but eventually, the deal is completed. Later you learn that the only homes the realtor showed you were ones that the conglomerate that owned the realtor’s firm had listed. The same Real Estate Conglomerate also owned the title company and the mortgage bank and the home inspector’s firm. You ruefully calculate by retrospectively comparing other non-conglomerate pricing that you paid way too much.

Thankfully, this dark scenario can’t happen under U.S. law because of legislation prohibiting these incestuous and monopolistic relationships. RESPA (Real Estate Settlement Procedures Act) and other antitrust regulations prohibit such self-dealing and require disclosure and freedom to seek other services outside of the conglomerate.

Unfortunately, such is not the case with mega for-profit health insurance companies. Currently, many for-profit insurance providers (UnitedHealth, Aetna, Cigna, Humana, Elevance) operate vertically integrated companies that not only offer health insurance, but often provide a provider network of physicians, pharmaceutical company and pharmacy benefit manager, and a medical device company that they own. So, if a person purchases one of these companies’ health insurance policies, they are often referred internally for all services. One can escape the network for other physicians or pharmaceuticals, but the costs are usually higher.

The problem is that there is a host of information showing that these companies are profiting off every step of the vertical referral chain and driving up health care costs. I previously posted data showing the cost overruns of Medicare Advantage over traditional Medicare (here and here). The WSJ also has an excellent expose on the rip-off of government and taxpayers by the mega for-profit health care companies (here). Among other strategies, the vertically integrated companies subverted federal guidelines designed to limit profitability of their insurance arm by taking additional pieces of profit out of the provider and pharmaceutical entities as well.

Well, help is on the way! In a rare bipartisan partnership, Elizabeth Warren (D-MA) and Josh Hawley (R-MO) have introduced the Breakup Big Medicine Act (here). This needed legislation would prevent vertical integration of health services and, if it becomes law, would require existing companies to divest of their vertical integration services within a year or face penalties. A company could not own both an insurance company and a physician network nor could they own a pharmaceutical chain or pharmaceutical benefit manager firm or medical supply company. Hospitals would still be allowed to have employed physicians. The legislation would be analogous to the Glass-Steagall act that regulated and separated commercial and investment banking, and to the RESPA act for realty. The hoped result would be to decrease overall costs and stimulate competition. But, given our lobby-driven system of legislation that gives disproportional power to monied interests, the chance of passage is meager.

There is a humorous You-Tube video with the satirical Dr. Glaucomflecken and Elizabeth Warren that is worth the few minutes to watch. It gets the point across:

|

| YouTube: Click here |

(courtesy of Dr. M. Matthews)

My own view is the bill is a step in the right direction. But as I’ve indicated earlier, if America wants to really effect health care reform and decrease costs while improving quality, we need a well thought out National Health Plan like virtually all other western developed nations. America has twice the cost and poorer outcomes compared to these other nations. Medicare -For-All is one avenue to get us there with the safeguards and reforms previously outlined (here) and (here).

Thanks for listening!